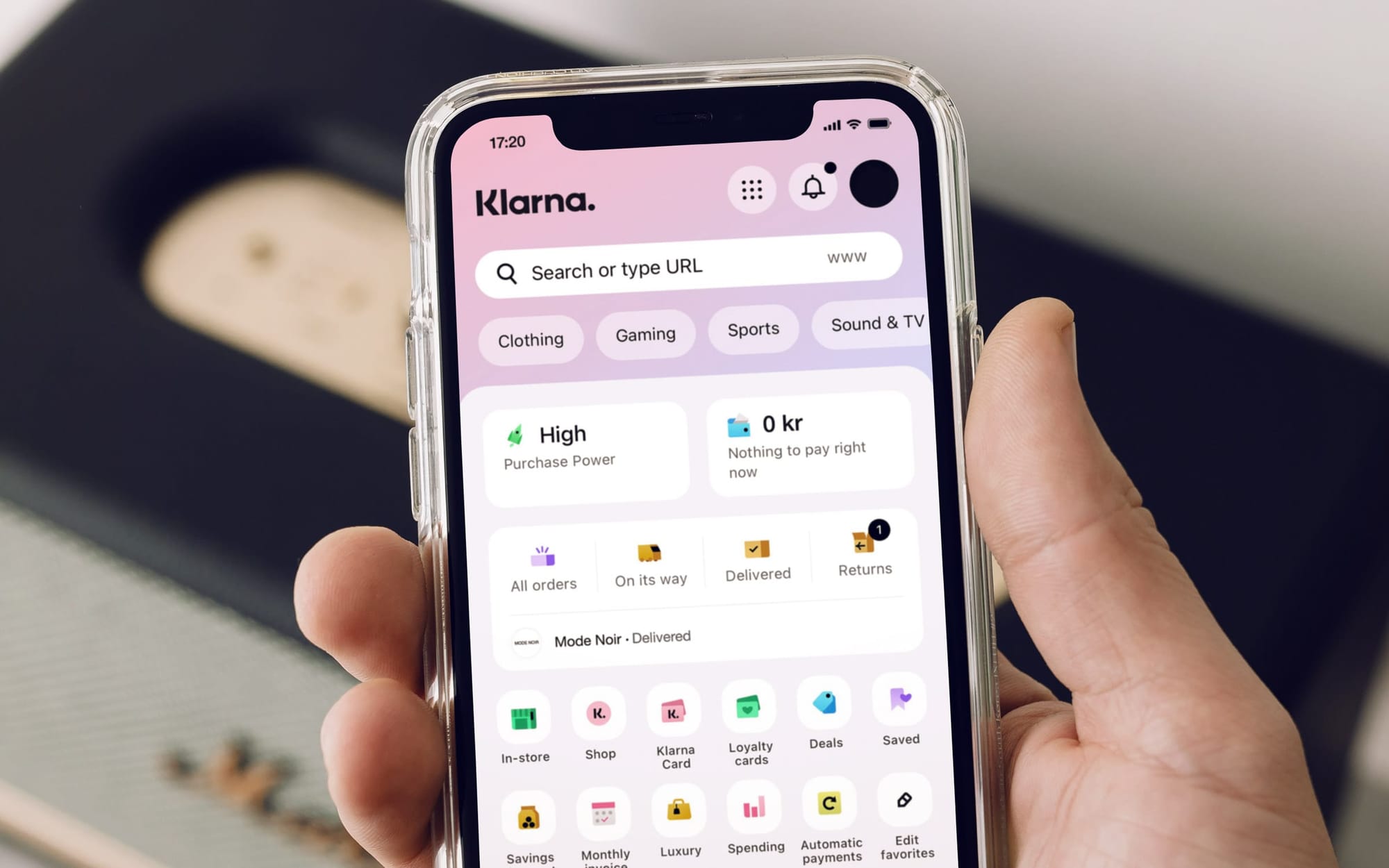

Does Klarna Help Build Credit? What You Need to Know

In today's fast-paced, digital world, shoppers have more payment options than ever before. One of the newer players in the market is Klarna, a popular payment service that allows you to buy now and pay later. With its enticing "buy now, pay later" model, Klarna has gained a loyal following of consumers who appreciate the flexibility it offers. But the question on many minds is, does Klarna help build credit? If you've been pondering this very question, you're in the right place. In this article, we'll delve into the details of Klarna and explore whether it can actually assist you in building your credit score. So let's dive in and uncover the truth behind Klarna's impact on credit building.

Understanding the Impact of Klarna on Your Credit Score

If you're an avid online shopper, chances are you've come across the name Klarna. This popular payment service allows customers to make purchases and pay for them in installments, making it easier to manage their finances. But have you ever wondered how Klarna affects your credit score? Let's dive in and explore this topic further.

First things first, it's important to note that Klarna is not a credit provider. Unlike a credit card or a personal loan, Klarna does not extend credit directly to its users. Therefore, using Klarna alone does not have a direct impact on your credit score. In other words, Klarna itself does not build your credit history or improve your credit score.

However, it's not all bad news for those wondering if Klarna can help build credit. While Klarna doesn't report your payment history to credit bureaus, some retailers who partner with Klarna might report your payments. So, if you make your payments on time and in full, it could indirectly have a positive impact on your credit score through these retailers' reporting.

To summarize, Klarna itself does not impact your credit score, as it is not a credit provider. However, using Klarna responsibly and making timely payments could indirectly help build your credit if the retailer reports these payments. If you're seeking to improve your credit score, it's crucial to also engage in other credit-building activities, such as paying your bills on time and managing your current credit responsibly.

In conclusion, while Klarna may not directly impact your credit score, it can still be a useful tool for managing your finances and making online purchases more convenient. Just remember that responsible use and timely payments are key to maintaining a good credit history.

Tips and Tricks to Boost Your Credit with Klarna

If you're looking to boost your credit score, you might be wondering if Klarna can help. The good news is that Klarna can actually be a valuable tool to help boost your credit when used strategically. Klarna is a fintech company that offers flexible payment options for online shopping, making it easier to manage your finances. So how does Klarna help build credit?

Firstly, Klarna can help you build credit by providing you with an opportunity to make timely payments. When you use Klarna, you typically have the option to split your payment into installments. By making these payments on time, you demonstrate to creditors that you are responsible and reliable. This can positively impact your credit score over time.

Secondly, Klarna offers a feature called "Pay Later". With this option, you can make a purchase and choose to pay for it at a later date. By utilizing this feature responsibly and paying off your balance promptly, you can show a positive payment history to credit bureaus. This can help improve your credit score and make you a more attractive borrower in the eyes of lenders.

Lastly, Klarna also reports your payment activity to credit bureaus, which can further aid in building your credit. When you make payments on time and responsibly manage your Klarna account, it will be reflected on your credit report. This can help establish a positive credit history and improve your overall creditworthiness.

So, while Klarna is not a traditional lender, it can still play a role in helping you boost your credit score. By utilizing Klarna responsibly, making timely payments, and utilizing features like "Pay Later", you can improve your creditworthiness and increase your chances of getting approved for loans and credit cards in the future.

The Benefits of Using Klarna for Credit Building

Credit building is an essential process for anyone looking to improve their financial standing and future borrowing opportunities. One popular tool that can help in this journey is Klarna, a leading Buy Now, Pay Later platform. While Klarna is primarily known for its convenient payment options, it also offers several benefits for credit building.

One of the main ways Klarna can assist in building credit is by reporting transactions to credit bureaus. By using Klarna responsibly and making timely payments, users can establish a positive payment history, which is a crucial factor in building a good credit score. This means that every purchase made through Klarna can contribute to improving one's creditworthiness.

Furthermore, Klarna offers a feature called "Pay in 4," which allows users to split their payments into four equal installments. This can be particularly helpful for individuals with limited budgets or those looking to control their spending. By making consistent payments on time, users not only avoid late fees, but also demonstrate their ability to manage credit responsibly.

Additionally, Klarna offers users the option to link their bank accounts or credit cards to their Klarna account. This allows for automatic payments and ensures that payments are always made on time. Automatic payments are a convenient way to avoid missed or late payments, which can negatively impact credit scores. By taking advantage of this feature, users can streamline their bill payments and contribute to a more positive credit profile.

In conclusion, Klarna can be a valuable tool for credit building. By reporting transactions to credit bureaus, offering flexible payment options, and providing the convenience of automatic payments, Klarna helps users establish a positive credit history. However, it's important to remember that responsible financial behavior is key. Making payments on time and keeping debt levels low are equally important. With Klarna's assistance, individuals can use their purchases and payments to their advantage in improving their creditworthiness.

How to Use Klarna Responsibly to Improve Your Credit

Klarna, the popular online shopping payment platform, has revolutionized the way we shop. With its "buy now, pay later" model, Klarna offers a convenient and flexible way to make purchases. But did you know that using Klarna responsibly can also help improve your credit?

One common question people often ask is, "Does Klarna help build credit?" The answer is yes, it can. Klarna reports your payment history to credit bureaus, such as Experian, which means that if you consistently make your payments on time, it can positively impact your credit score. This is why it is crucial to use Klarna responsibly and make payments in a timely manner.

To make the most out of Klarna and boost your credit, it's important to keep a few things in mind. First, only use Klarna for necessary purchases that you can afford to repay comfortably. It's tempting to overspend and rely on Klarna's payment flexibility, but it's essential to avoid accumulating unnecessary debt. By using Klarna responsibly and paying off your purchases promptly, you can avoid high interest rates and build a positive credit history.

Another helpful tip is to keep track of your Klarna payments and due dates. Missing a payment or paying late can have a detrimental effect on your credit score. Set reminders, create a budget, and stick to it to ensure you never miss a payment. By doing so, you not only avoid late fees but also maintain a good credit standing.

In conclusion, Klarna offers a convenient and flexible way to make purchases, and if used responsibly, it can also help improve your credit. Just remember to use Klarna for necessary purchases, make payments on time, and keep track of your due dates. By doing these simple steps, you can enjoy the benefits of Klarna while enhancing your creditworthiness at the same time.

Klarna Credit Building: Dos and Don'ts

Building credit is an essential step towards financial stability and future success. Many people are turning to Klarna as a way to make purchases and gradually build credit. But does Klarna help build credit? The answer is yes, but it's important to be mindful of certain dos and don'ts to ensure you're making the most of this credit-building opportunity.

Firstly, one of the most important dos when using Klarna to build credit is to make your payments on time. Late or missed payments can have a negative impact on your credit score, so it's crucial to be responsible and stay on top of your payment schedule. Set reminders or use automatic payments to avoid any slip-ups.

Another important thing to keep in mind is to keep your credit utilization ratio in check. This ratio refers to the amount of credit you're using compared to your overall credit limit. It's recommended to keep your utilization ratio below 30% to maintain a good credit score. So, even though Klarna might provide you with a higher credit limit, it's wise to only use what you really need and not max out your credit.

On the flip side, there are also some don'ts to remember when using Klarna for credit building. One common mistake is opening too many Klarna accounts or applying for multiple new credit lines at the same time. This can make you appear risky to lenders and may lead to a drop in your credit score. It's best to be strategic and only open new accounts when necessary.

In conclusion, Klarna can indeed help you build credit if used responsibly. Make your payments on time, keep your credit utilization ratio low, and avoid opening too many credit accounts simultaneously. By following these dos and don'ts, you can leverage Klarna as a valuable tool in your credit-building journey.

Leveraging Klarna to Enhance Your Credit Profile

When it comes to building and improving your credit profile, one tool that often gets overlooked is Klarna. Many people are familiar with Klarna as a popular buy now, pay later service, but did you know that it can also help you build credit? Yes, you heard it right. Klarna can be leveraged to enhance your credit profile and boost your credit score.

So, how does Klarna help build credit? The answer lies in the way Klarna reports your payment activity to credit bureaus. When you use Klarna to make purchases and pay them off on time, Klarna reports this information to credit bureaus, thereby adding positive payment history to your credit report. This not only demonstrates responsible financial behavior but also helps to establish a positive credit history, which is crucial for improving your creditworthiness.

Furthermore, utilizing Klarna responsibly can also help in diversifying your credit mix. Credit mix refers to the different types of credit accounts you have, including revolving credit (such as credit cards) and installment credit (such as loans or mortgages). By using Klarna, you are adding an installment credit account to your credit mix, which can have a positive impact on your credit score.

It is important to note, however, that while Klarna can be a helpful tool for building credit, it is not a guarantee. Building and improving credit takes time and requires responsible financial habits. Make sure to make all your Klarna payments on time and in full to maximize the benefits it can offer to your credit profile. By leveraging Klarna, you can take one step closer to a healthier credit profile and improved financial standing.